Having access to the correct tools and software is necessary for successful trading in today’s fast-paced stock market. Advances in technology have given traders an endless number of options to select from. The top 7 best stock market software & trading tools in 2024. This tool can also be used on a computer or mobile device.

List of the Top 7 Best Stock Market Software and Trading Tools

Here are the top 7 best stock market software and trading tools with their pros and cons.

1. TradingView

A well-known web-based program called TradingView provides a wealth of capabilities for technical analysis, That’s why I have included it in the list of best stock market software. Its user-friendly design and strong charting features make it simple for traders to study equities, currencies, and commodities. TradingView is an excellent tool for the trading community since it enables users to generate and exchange their trading concepts.

Reasons to use TradingView

- Access the line draw and text tool without having to scroll so far

- Very user friendly various layouts and features

- Best for charts

- Greatest tool for back testing, analysing etc.

Reasons to avoid TradingView

- Locked away previously free features

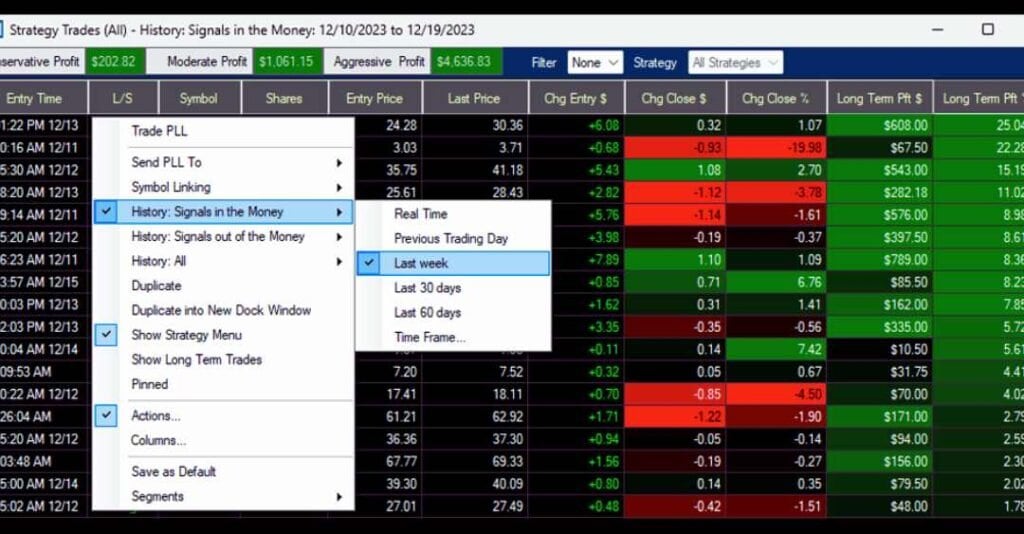

2. Trade Ideas

If we talk about top stock trading software, how can we forget Trade Ideas? It is also a powerful tool in the share market. Trade Ideas is an alert and stock scanning system driven by artificial intelligence that gives traders access to current market information like BSE, NSE, and Nifty Sensex Share Price. This program analyses enormous volumes of data and provides trading ideas that may be put into practice using machine learning techniques. Trade Ideas assists traders in staying ahead of the curve and making wise trading decisions with its adjustable filters and notifications.

Reasons to use Trade Ideas

- Trade Ideas real-time data

- Trade smarter and faster by monitoring all of your positions and trade metrics in one place

Reasons to avoid Trade Ideas

- Long-time client unable to get substantial discount rate

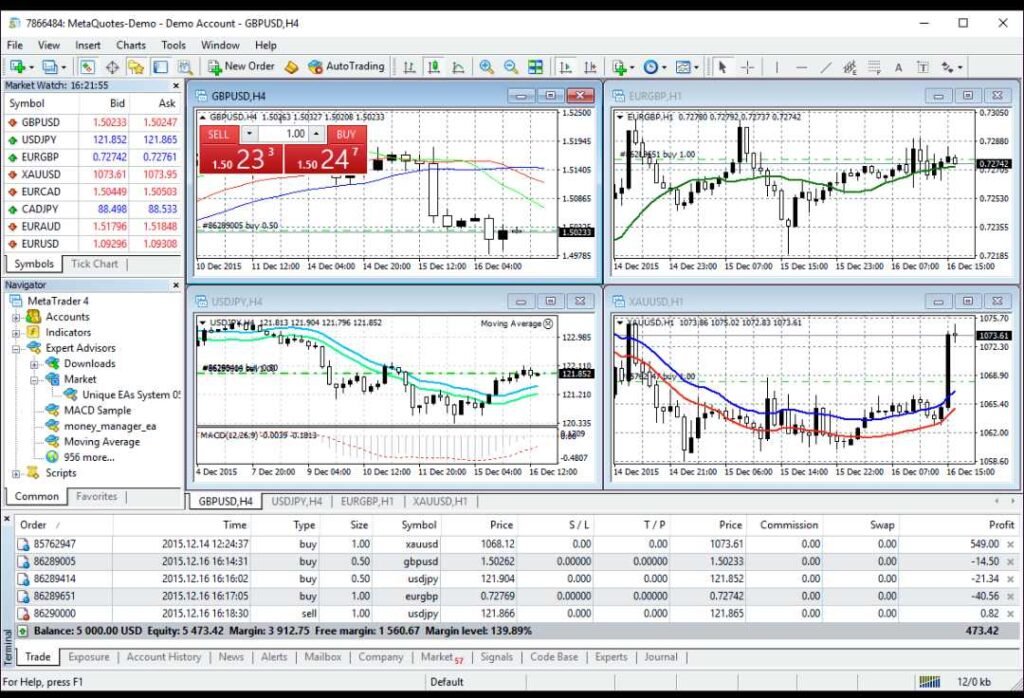

3. MetaTrader 4

MetaTrader 4, or MT4, is an actively used trading platform utilized in the areas of forex and CFD trading. This best stock market software provides a wide range of tools for technical analysis, automated trading alternatives, and a user interface that is simple to use. Moreover, MT4’s extensive broker support makes it an adaptable option for traders worldwide.

Reasons to use MetaTrader 4

- Great way to learn, there's should be an account that is very small for new trader

- Easy to use and understand if you have already idea how to trade

Reasons to avoid MetaTrader 4

- Slow to loading full chart patterns

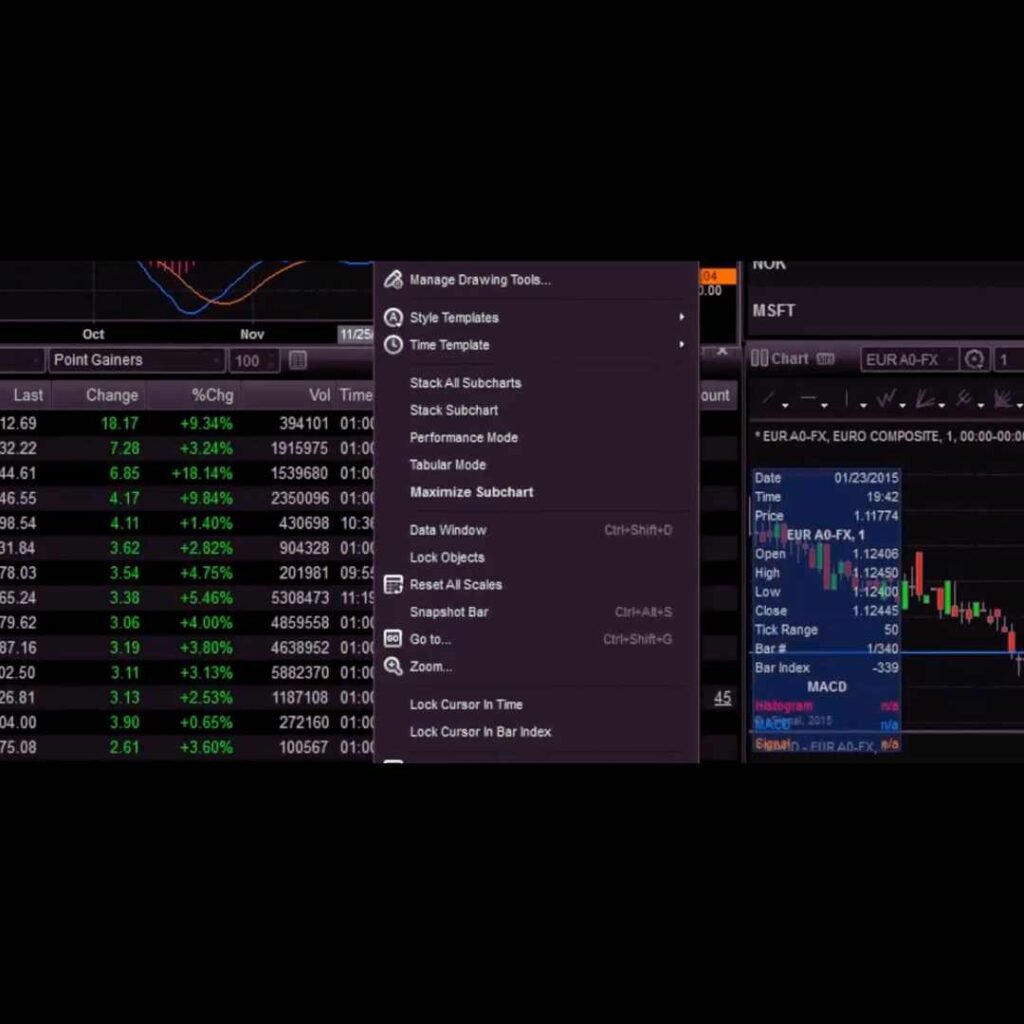

4. eSignal

eSignal is a strong platform for analysis and charting that offers advanced charting tools and real-time market data. This best stock trading software gives traders that can make well-informed trading decisions and conduct in-depth technical analyses with the assistance of various drawing tools and indicators. In addition to customizable alerts and watch lists, eSignal guarantees that traders never miss an opportunity.

Reasons to use eSignal

- Customizable charts that allow you to create charts

Reasons to avoid eSignal

- Not all feature free

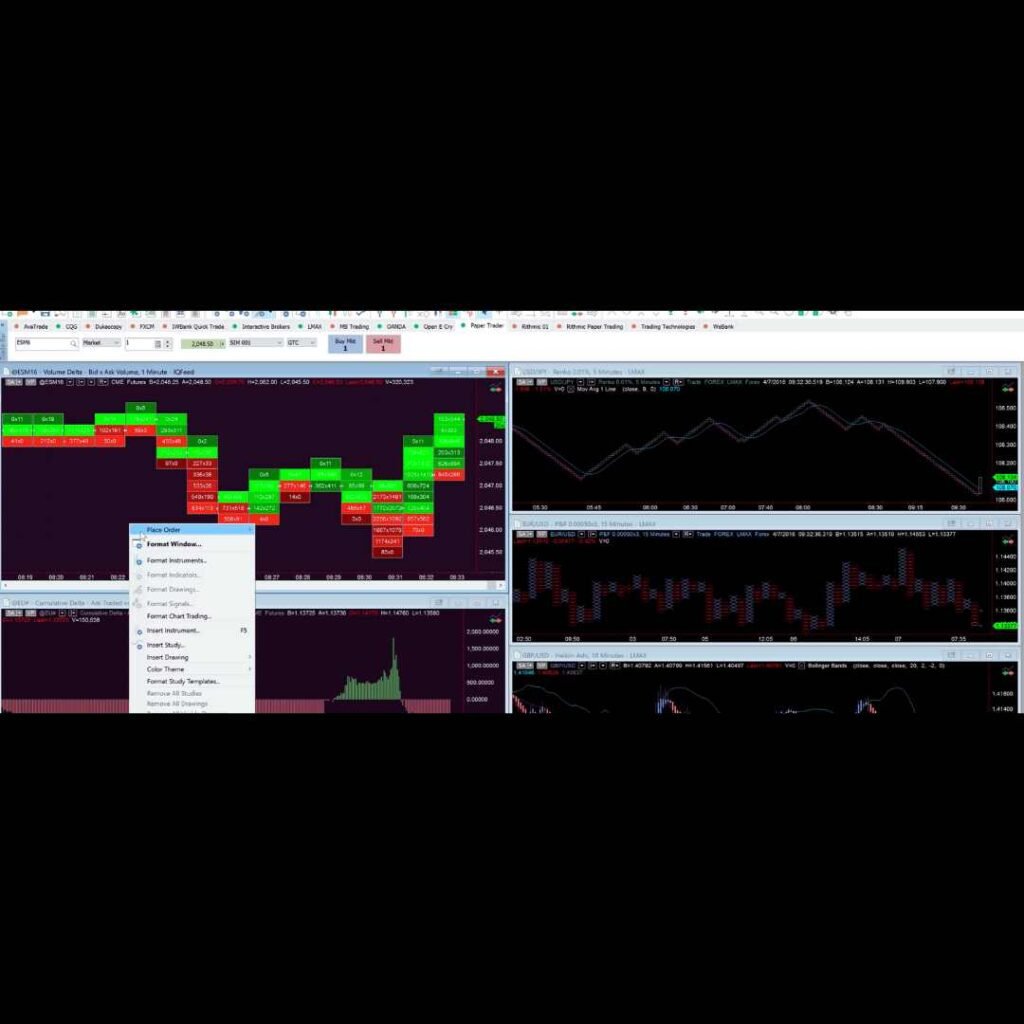

5. Multicharts

Multicharts is the best trading software in India with professional quality that accommodates both novice and seasoned traders. In addition to modern charting, strategy development, and backtesting capabilities, it provides a broad range of features. A lot of trader’s favour “Multicharts” because of its simple layout and support for multiple brokers; it is a comprehensive trading platform.

Reasons to use Multicharts

- Charting, backtesting and multi-broker automated trading

- Automated execution and support for easylanguage scripts are all key tools at your disposal

Reasons to avoid Multicharts

- Not all feature free

6. TradeStation

TradeStation is an industry-leading top trading tool platform that offers traders accurate execution and analysis tools. By utilizing the platform’s sophisticated charting functionalities and strategy development tools, investors can generate and evaluate their trading strategies. In addition to a powerful community and an extensive selection of educational resources, TradeStation is an outstanding option for traders of all skill levels.

Reasons to use TradeStation

- Very convenient, easy to use

- Customer service was great

Reasons to avoid TradeStation

- Desktop program is highly advanced

7. TrendSpider

TrendSpider is an best stock market analysis software that finds trends and patterns in stock charts using artificial intelligence. Traders can leverage the automated trendline and Fibonacci drawing tools to improve their technical analysis skills and optimize their time management. In addition to real-time alerts and backtesting capabilities, TrendSpider assists traders in monitoring share market movements.

Reasons to use TrendSpider

- Quick checks of charts and very accurate

- Automatic trend lines

Reasons to avoid TrendSpider

- Mobile app and desktop feature not same

Best Stock Market Software and Trading Tools FAQs

Why is it important to use stock market software and trading tools?

Trading software and other tools for the stock market can give players an edge in the market. You can use these tools to make advanced charts, get real-time data, use technical analysis indicators, and set up automated trade. They help traders make smarter choices, find better trading chances, and handle risk better.

Are this stock market software and trading tools suitable for beginners?

Many of the software and tools that were discussed can be used by traders of all levels, even those who are just starting out. For people who are new to trading and technical analysis, platforms like TradingView, MetaTrader 4, and TradeStation have easy-to-use tools and learning materials that can help them get started. They also give traders access to a helpful community where they can learn from pros with years of experience.

Can I use more than one trading tools and stock market software at the same time?

Yes, you can use more than one piece of program or tool at the same time. In fact, a lot of traders like to use more than one platform’s tools to get the most out of each one. TradingView is used for charting and technical analysis, Trade Ideas is used for scanning and warning systems, and MetaTrader 4 is used to make trades. But it’s important to make sure that the tools work with each other and don’t cause any technical problems.

Do I need to work with a certain broker to use these tools and software?

A lot of different brokers can work with most stock market apps and trading tools. But it’s important to make sure that the software works with the broker of your choice before making a choice. MetaTrader 4 and TradeStation are two platforms that can work with more than one broker. Other platforms may only work with certain trading firms.

Is it free to use this stock market software and to trading tools?

Software and trade tools for the stock market come in a range of formats and prices. There are free versions of some platforms with fewer features, while others need a membership or a one-time payment to give you access to all of their features. You should look into the different tools and compare their prices, features, and user reviews to find the one that fits your trade needs and budget the best.

Also Read: