Here is the way to Close your HDFC Bank loan Online. You can also manage, repay, repayments schedule, and Make Partial Payments on any of the loans easily from home. HDFC offers this service to users to manage their loans digitally online.

Close HDFC Personal loan / Auto loan/ Two-wheeler loan/ Business loan/ Consumer Durable Loan Online

How To Close HDFC Bank loan Online?

Follow the below simple steps and close the loan. Live your life tention free and loan free.

Step1 : Login to web link https://apply.hdfcbank.com/digital/retail_assets_phase2#DT_HomePage

Step 2 : Select the linked loan to be closed. Select the type of service as foreclosure request. Select your city and nearest branch from the dropdown.

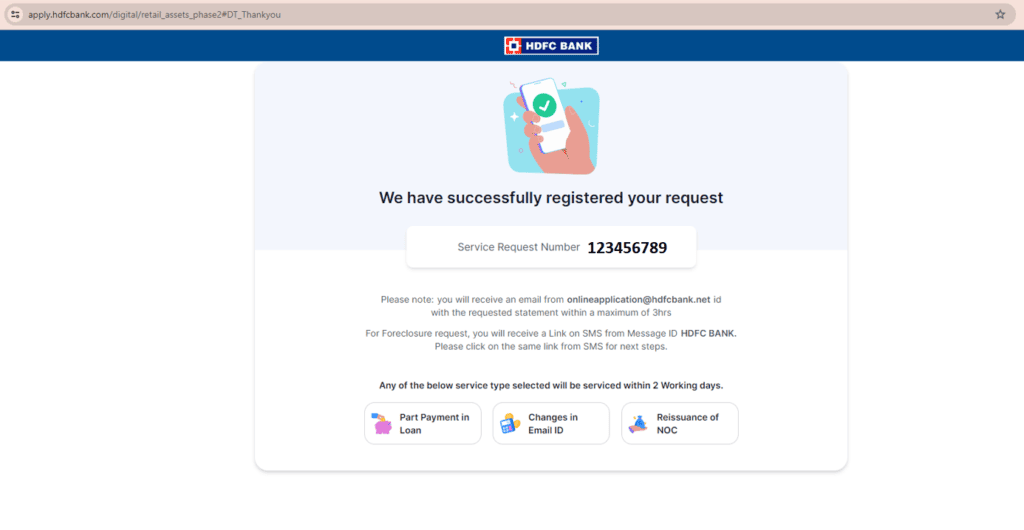

Step 3: Select the reason for the closure and confirm once the outstanding loan amount is shown. Save the request

Step 4: Click on the link received in SMS and validate using OTP. Confirm to terms and conditions and make the payment on a payment gateway.

Voila! Payment completed – loan is on its way to closure. SMS will be received as soon as the loan is closed in the bank’s portal

What Is diffrent Types of Loans?

Personal Loan:

A personal loan is a type of unsecured loan that can be used for various purposes such as debt consolidation, home renovation, medical expenses, or any other personal need.

Auto Loan:

An auto loan is specifically designed to finance the purchase of a vehicle. Banks offer auto loans with competitive interest rates and flexible repayment options.

Two-Wheeler Loan:

Similar to an auto loan, a two-wheeler loan is specifically tailored to finance the purchase of a two-wheeled vehicle such as a motorcycle or scooter. Online platforms make it easy for individuals to apply for two-wheeler loans by providing the necessary information and documents through a digital interface.

Business Loan:

Business loans are financial products designed to provide funding for business-related purposes such as starting a new venture, expanding an existing business, purchasing equipment, or managing cash flow.

Consumer Durable Loan:

Consumer durable loans are specifically designed to finance the purchase of consumer durables such as electronic appliances, furniture, or home appliances.